Autumn 2025 Budget Summary

- Gregory Deer

- Nov 26, 2025

- 3 min read

Updated: Nov 27, 2025

High earning professionals have seen another shift in how they must manage their money.

Living standards are likely to be squeezed again as you pay more tax and companies are set to contribute more to HMRC.

How did we get here?

Government spending has increased due to

Higher interest rates on government borrowing

Welfare-related spending cuts voted down by MPs

Increased defence and public spending

As a result, the government has run a deficit (spending is greater than income) every year since 2000/01. The national debt has grown for 25 years and is set to grow further.

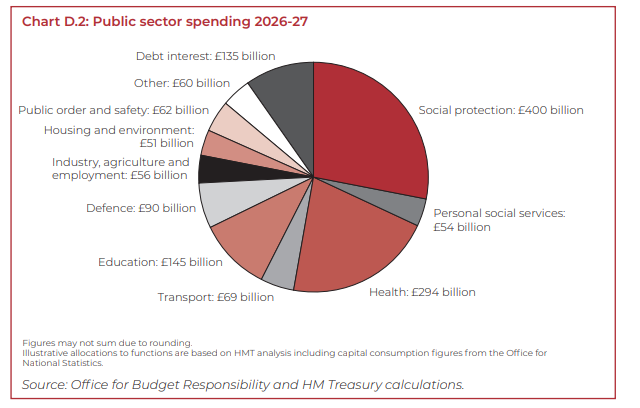

A chart showing government spending is below:

What's been announced?

A summary of the key changes, including the ongoing ‘stealth tax’ and increases to investment income tax are in the table below:

How could it impact you?

We all want to know how it will impact us. Here is how the budget could impact you.

Slower pay growth and smaller pension boosts

Companies’ costs increase again. Last year, we saw increases to employer National Insurance Contributions (NICs). This year, there’s more pain for companies.

Removal of salary sacrifice beyond £2,000 from April 2029 will increase employer NICs further.

This is likely to lead to two things:

Slower growth in employee salaries

Lower employer pension contributions due to increased costs

Mortgage rates could decrease

The Bank of England is already expected to reduce interest rates later this year.

In their most recent predictions, the Office of Budget Responsibility increased inflation forecasts.

Interest rates can be lowered to stimulate the economy. Next year inflation is forecast at 2.5%, but the Bank of England aims for 2% inflation.

We could see further interest rate decreases, but perhaps at a slower rate than initially expected.

Lower living standards

We all want our standard of living to increase. More dinners out, nicer holidays, money in our pocket for special occasions.

The 2025 budget is likely to mean working professionals have less money for living. Announced tax rises could increase living costs, reduce after tax pay and lead to a lower standard of living.

Median weekly pay has barely increased since 2007 (Commons library) , meaning living standards have been stuck for nearly 20 years. I’m not expecting much change!

What can you do now?

With all this in mind, how can you prepare for the next few years?

Keep your fixed costs low. Having low fixed outgoings gives you flexibility. In an uncertain world, stay flexible.

Maximise pension salary sacrifice, while you can. Salary sacrifice is here for the next 3 years, make the most of it by topping up your pension if affordable.

Maximise cash ISAs, while you can. Now is the time to stash your cash ISA with your emergency fund.

Summary

Budget 2025 represents a squeeze on earners, businesses, and households, especially for the “squeezed middle.”

Higher taxes, frozen thresholds and rising costs mean that even those on good incomes may feel financial pressure.

For 30-50 year-old professionals juggling mortgage, family, ambitions and savings, managing your money well is more important than ever.

Want help managing your money? Book a call with us to reduce your stress levels and maximise what you have using the link below.

Risk warnings

Investments do not give the same capital security as cash deposits. Investments carry risks. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Tax rates may change in the future.

The above article is not financial advice. If you need financial advice, please see an independent financial adviser (like us!).